Tips on Flying

I used my airline miles to reserve a flight to New Jersey to see family next week…

First flight tip: I went to American Airlines and was going to reserve seats last night but grumbled about having to redeem 50,000 miles + $60 instead of 25,000 miles to fly on the day I wanted (Sept 27th). Apparently, when you book < 21 days in advance, you get hit with a $50 surcharge, and I would have to fly 3 days earlier on Wednesday to fly for 25,000 miles. Grumble grumble. So I log on today and there are several seats available for 25,000 miles + $60. I took it! I’m guessing that the inexpensive airline miles seats opened up “10 days” before the flight. The flight is on the 27th and today is the 17th.

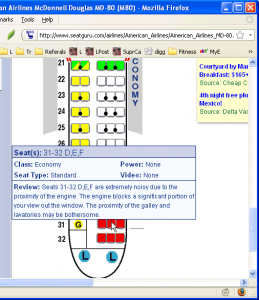

Second flight tip: I went to SeatGuru.com to look at the plane. Good thing. I had been automatically assigned seat E-31 on American’s MD-80. That is 1 row in front of the bathroom, very loud due to the engine’s proximity and no view due to the engine just outside the window. Reading this description, I recall sitting in this seat in 2004 on my flight back from Burning Man. It was awful, like being trapped in a basement under a power plant for a few hours. So I moved my seats. Apparently, AA puts people in those yucky seats by default. I saved myself 3 rides in the back of the bus by selecting my seats.

Second flight tip: I went to SeatGuru.com to look at the plane. Good thing. I had been automatically assigned seat E-31 on American’s MD-80. That is 1 row in front of the bathroom, very loud due to the engine’s proximity and no view due to the engine just outside the window. Reading this description, I recall sitting in this seat in 2004 on my flight back from Burning Man. It was awful, like being trapped in a basement under a power plant for a few hours. So I moved my seats. Apparently, AA puts people in those yucky seats by default. I saved myself 3 rides in the back of the bus by selecting my seats.

Third flight tip: Use credit cards that earn you miles. Right now in my wallet is an AAdvantage CitiBusiness Citi Mastercard. They will give me 25,000 miles if I spent $750 in 4 months. I’m 3 weeks in and have spent $550. I have another AAdvantage Citi Mastercard; I did the same on that card in May. I called to cancel and they offered me 5 “miles” for every dollar I spend at gas stations, supermarkets and drug stores for a year. So I’ll use the latter card for gas and the former for everything else. Of course, I’ll make sure to cancel my card before the anniversary date, when they charge me an $85/year membership fee. I’ve earned about 100,000 airline miles in the last 3 years doing this. I’ve found many of these deals at Citicards.com. I’m a little concerned about hurting my credit rating, flipping cards so quickly; so I’ve made sure to have a max of 3 cards at any time and I pay them off completely every month (habitual non-payment of credit debt is, as we all know, for suckers).