Today’s Quote

“You can’t manipulate someone with candor and truth. That is called enlightenment.”

– (slightly paraphrased) from the book Changes by Jim Butcher

The coldest winter I ever spent

Archive for November 2019

“You can’t manipulate someone with candor and truth. That is called enlightenment.”

– (slightly paraphrased) from the book Changes by Jim Butcher

I had to stay home sick. Blah. Just lots of mild “blah” symptoms all over my person. I’m laying low so I feel better for my trip to Florida over Thanksgiving break!

Hypothetically, if you had three student loans totaling about $100,000 at different interest rates… say $3%, 5%, and 6%, would you push to pay them off or invest the “extra” money in the stock market?

My first thought was that the stock market generally pays 7% interest so I should pay down the 6% loan and put all the rest of the money into the stock market, but now I’m second-guessing myself. Thoughts?

Of course, first priority is to make a rainy day fund and pay into any matching 401(k) programs.

…

I found some answers for myself….

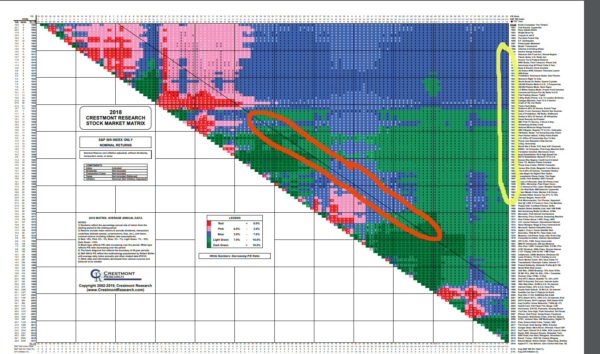

Look at this cool chart (via) (local copy). This chart shows how the S&P 500 index performed over the past hundred years. There is a “20 year” diagonal line, I highlighted it in red in the image to the right. Read the numbers on that line. For investments put in from 1930 until today, the S&P 500 has made pretty reliable 7% interest (as low as 4%, as high as 14%) per year. If you can wait 30+ years (highlighted in yellow in the image to the right), it’s a VERY reliable 7-9% interest rate, you can see that by looking at the far right side of the chart. Looking at the 10 year diagonal, the interest rates are more variable, -4% to 14%.

Look at this cool chart (via) (local copy). This chart shows how the S&P 500 index performed over the past hundred years. There is a “20 year” diagonal line, I highlighted it in red in the image to the right. Read the numbers on that line. For investments put in from 1930 until today, the S&P 500 has made pretty reliable 7% interest (as low as 4%, as high as 14%) per year. If you can wait 30+ years (highlighted in yellow in the image to the right), it’s a VERY reliable 7-9% interest rate, you can see that by looking at the far right side of the chart. Looking at the 10 year diagonal, the interest rates are more variable, -4% to 14%.

I’ve got about 20 years to retirement. With a 20 year window, the S&P 500 should always beat a 4% loan. Everything else is a crap-shoot. For example, with a 10 year window, $100,000 could balloon into $370,000 (that’s 14%, compounded yearly) woo hoo! That’s a nice nest-egg to retire on! Or, it could eviscerate $100,000 into $66,000 (4% loss, compounded yearly). [sad trombone] enough to get me into a chichi cardboard-box retirement community.

So what to do?

Since I’ve got 20 years left, invest in the stock market (claiming my 4 – 14%), making sure to diversify enough to match the S&P 500. But in 5 years, it’ll be time to switch to the safer (3 – 6%) investing of paying down student loans instead of continuing to invest in a riskier 10 year plan that pays (-4% – 14%).

There was this awful noise that I’d sometimes hear in my room at school. It sounded like a machine in the walls suddenly turning on. Sometimes for a half a second, sometimes for a minute. On and off, on and off! It’d come on a bit more around 11am or so so I thought it might be related to kids going to the nearby bathroom. When it was happening and I had the opportunity, I’d run around the building looking for the source. It wasn’t the air conditioning, wasn’t the bathrooms, wasn’t the heaters, wasn’t the neighboring classrooms playing with power tools. I talked to the school custodian, to the neighboring teachers. But they all thought I was mad. I wasn’t mad! I wasn’t! I swear it!

Then, a few days ago, more than a YEAR after first noticing the sound, I found it! A water hammer in the sink of the classroom two doors down. So simple! When the kids were cleaning up from morning work, they’d turn on the water. Curiously, it was quieter in the room with the offending sink than in mine.

I got the most joy when Ms. S. the teacher one door down told me how for the last DECADE she was explaining-away that horrible sound to her students. We were both beaming!

I went to the custodian and explained what was going on. We wrote up a work order for the plumber together. And 3 days later, with one gentle turn of a wrench, the problem dissolved into the mists!